E-invoicing is becoming the new norm for businesses in Malaysia. If you run a company, sell products, or provide services, you’ll soon need to follow the new tax rules. These rules will affect how you create and send invoices. By 2025, most businesses will need to switch to digital invoicing.

This change might feel big at first. But with the right tools, it can make your work easier and faster. This guide explains everything you need to know about e-invoice Malaysia, who must follow the rules and how to set up your e-invoice system without stress.

Let’s break it down step by step. By the end of this, you’ll know how to prepare your business for the change.

What Is e-Invoicing and Why Does It Matter in Malaysia?

E-invoicing means sending invoices through a digital system. In Malaysia, it’s not just about going paperless. It’s about following new tax laws.

Each invoice must go through the LHDN’s e-invoice system. This is the government’s platform. It checks and approves every invoice before you can send it to a customer. This process makes sure all taxes are recorded and tracked properly.

So, what makes it different from regular invoices? You don’t just print or email a PDF. You use a system that connects to the LHDN. This system creates invoices in a special format (XML or JSON). It then sends them for approval. Once approved, the invoice gets a unique number and a QR code.

Why does this matter? Because it stops fake invoices. It also helps the government track taxes better. For you, it means fewer mistakes and less paperwork. It helps speed up payments too.

By 2026, all businesses in Malaysia must use this method unless their annual sales are below RM500,000. So, it’s not just for big companies. If you’re running a shop, a small firm or even selling online, this change could apply to you.

Getting ready now helps you stay ahead and avoid last-minute stress.

Who Needs to Comply with Malaysia’s e-Invoicing Regulations

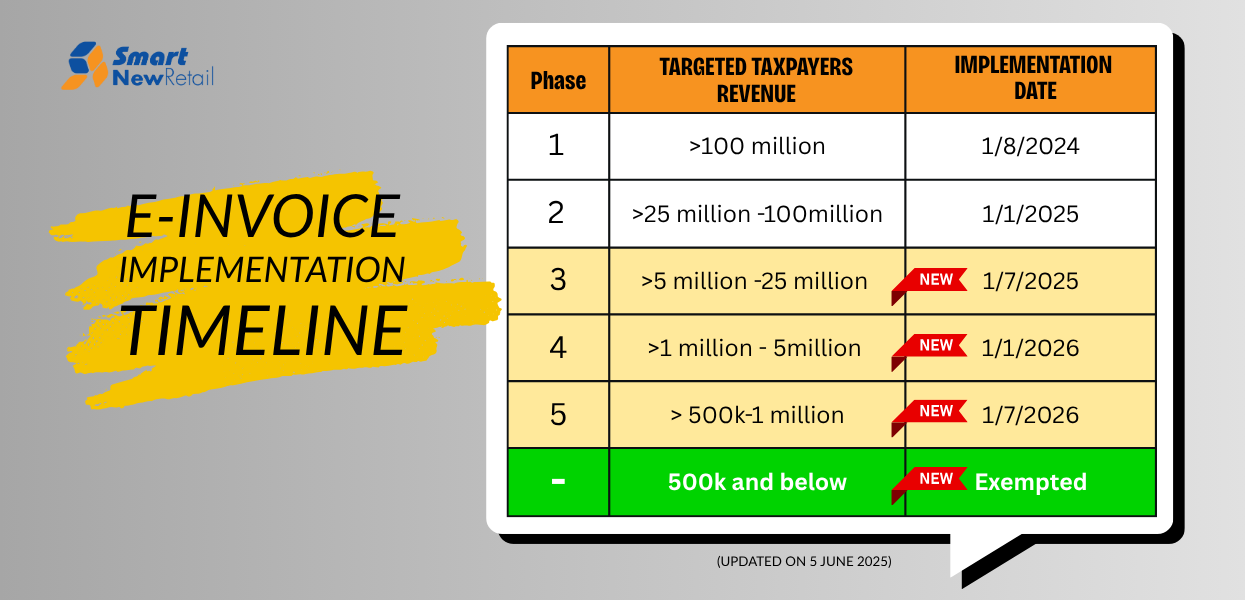

Malaysia’s e-invoicing rules apply in stages. The size of your business decides when you must start.

Here’s the timeline:

- From August 2024: Companies with sales over RM100 million

- From January 2025: Sales between RM25–100 million

- From July 2025: Sales between RM5–25 million

- From January 2026: Sales between RM1–5 million

- From July 2026: Sales below RM1 million, unless under RM500,000 (exempt)

The rules apply to all business types. This includes companies, partnerships, and even co-operatives. You must follow them whether you sell to other businesses, customers, or the government.

If your revenue grows and crosses a threshold, you’ll need to start using Malaysia e invoicing. So, even if you don’t need to follow the rules yet, it’s smart to start planning. This isn’t just about tax. It’s about keeping your business ready for future changes.

Key Features to Look for in an E-Invoice System

Choosing the right e invoice system makes a big difference. It should make your work simple, not harder. Here’s what to look for:

1. Compliance with LHDN

The system must follow the rules set by LHDN. It should send invoices in the correct format. It must also connect to the LHDN portal. This lets your invoices get approved before they go to your customers.

2. Real-Time Submission

Your system should send and receive invoices fast. Real-time updates help avoid delays and mistakes. This keeps your cash flow moving.

3. Support for All Document Types

You’ll need to send more than just invoices. The system should handle credit notes, debit notes, and refund notes too. All of these must follow the same format.

4. Integration with Sales Channels

Your e invoice pos system should work with your sales tools. Whether you sell in-store, online, or both, the system should pull data from all places. This keeps your records clean.

5. Safe and Secure

Data safety matters. Look for a system with strong security. It should protect customer details and business data. Only the right people should have access.

6. User-Friendly

The system should be easy to use. Your team should not need weeks of training. A simple dashboard, clear steps, and helpful alerts can make things smoother.

7. Human-Readable Formats

Sometimes, your customers will want to see the invoice in PDF. Make sure your system can create a clean copy that’s easy to share and print. Pick a system that works for now and can grow with your business.

Know More Information about E-commerce Integration with POS in Malaysia

Benefits of Adopting E-Invoice Software Early

Starting early makes things easier. If you wait until the last minute, problems can arise. Getting ahead helps your business run smoothly, stay stress-free, and stay ahead of the competition.

1. No Rushed Setup

You get time to test your tools, train your team, and fix issues. This way, you’re not in panic mode later.

2. Better Accuracy

Using e invoice software cuts down on errors. You don’t need to key in things twice. The system helps you follow the right format, every time.

3. Faster Payments

Customers, get your invoices quicker. They can pay sooner. This helps your cash flow and avoids late payments.

4. Less Paperwork

Digital invoices save space and time. You can track them with a few clicks. No more sorting paper or chasing missing files.

5. Tax Made Simple

Since the invoices are already approved by LHDN, filing your taxes gets easier. You’ll have fewer surprises during audits.

Getting ahead gives you peace of mind. It also helps you make smarter business choices.

Why Smart-Acc’s E Invoice POS System is Built for Malaysian Businesses

Smart-Acc offers a POS system that fits what Malaysian businesses need. It works for retail shops, food outlets, service firms, and more.

The system supports real-time invoice submission. It connects with your sales system and sends data straight to LHDN. You don’t need to upload files or switch screens.

It can handle different invoice types like sales, credit notes, and refunds. It also supports monthly consolidation for B2C sales if needed.

What makes it useful is how it links your store, your invoices, and your tax records in one place. You can track every sale, every customer, and every tax point without confusion.

Even better, you don’t need to change how you work. The system fits your current flow and just adds compliance. It’s designed to be simple, safe, and fast.

This makes Smart-Acc a strong choice for growing businesses in Malaysia.

Step-by-Step: How to Transition to E-Invoicing with Smart-Acc

Switching to e-invoicing doesn’t have to be tough. Follow these steps to make it smooth:

1. Know Your Timeline

Check your revenue and match it with the compliance dates. If you're over RM5 million, July 2025 is your key date.

2. Review Your Current Tools

Look at your billing or POS tools. Can they handle Malaysia e invoicing? If not, it’s time for an upgrade.

3. Pick the Right System

Choose one that fits your business. It should work with your setup and follow LHDN rules.

4. Train Your Team

Show your staff how to use the system. Let them practise before you go live.

5. Test with Sample Invoices

Run a few test invoices. Check if the system talks to LHDN. Fix any issues early.

6. Go Live and Track

Once ready, go live. Watch the system for a few weeks. Keep checking that everything works right.

Taking the time to set things up right means fewer problems down the line.

Conclusion

E-invoicing is here to stay in Malaysia. If you run a business, you need to get ready. Whether you're a small café or a large trading company, these rules will soon apply to you.

By planning now, you avoid the stress of last-minute changes. A good e invoice system helps you stay in control. It also keeps your business in line with tax rules.

Look for simple tools that work with your sales, help you track your invoices, and keep your data safe. The sooner you start, the easier your path will be.

At Smart-Acc, we offer an LHDN-compliant POS and e-invoicing system built specifically for Malaysian businesses. From real-time submission to multi-format support, our solution helps you stay compliant without changing your existing workflow.